US Cyber insurance monitor

Gain exclusive access to the US cyber insurance market’s most in-depth insights with QCC’s US Cyber Insurance Monitor (UCIM), powered by official NAIC data.

Gain exclusive access to the US cyber insurance market’s most in-depth insights with QCC’s US Cyber Insurance Monitor (UCIM), powered by official NAIC data.

DATA-DRIVEN

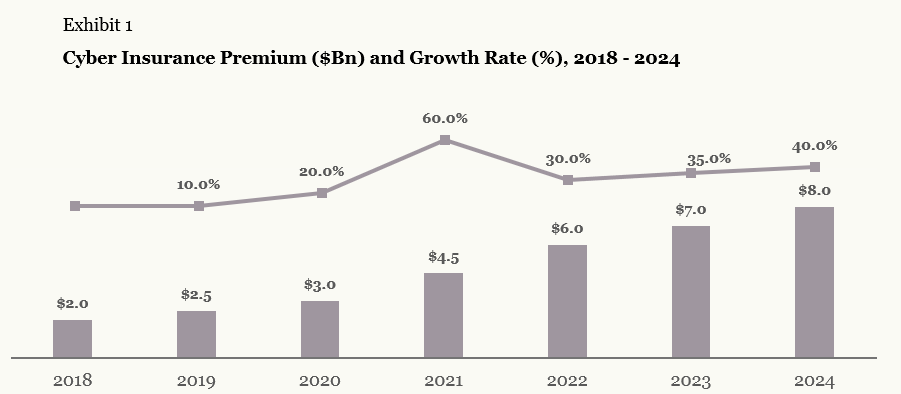

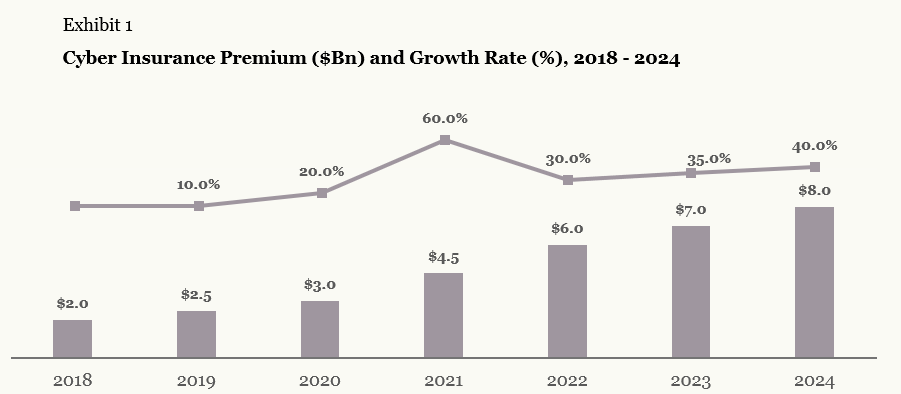

The QCC U.S. Cyber Insurance Monitor delivers the industry’s most trusted data, analysis, and forecasts on the U.S. cyber insurance market. In 2024 admitted premium declined for the first since the NAIC is collecting information, a 2.3% drop to $7.1 billion, signaling a turning point for the market. The Monitor provides clear insights into market concentration, profitability, and strategic segmentation, showing how leading carriers and emerging MGAs are shaping the competitive landscape. With full access to the underlying NAIC data, it equips industry leaders with the intelligence needed to run their own analysis, benchmark performance, anticipate trends, and stay ahead in an evolving market.

1

Unlock deep intelligence on the US cyber market, top 30 providers, performance metrics, and strategic trends with our Market Report.

2

Access the underlying raw data by the NAIC as part of the UCIM.

3

Analyze regulatory data from more than 200 US cyber insurers.

Direct Written Premium: outlines total premium volume in the U.S. cyber market.

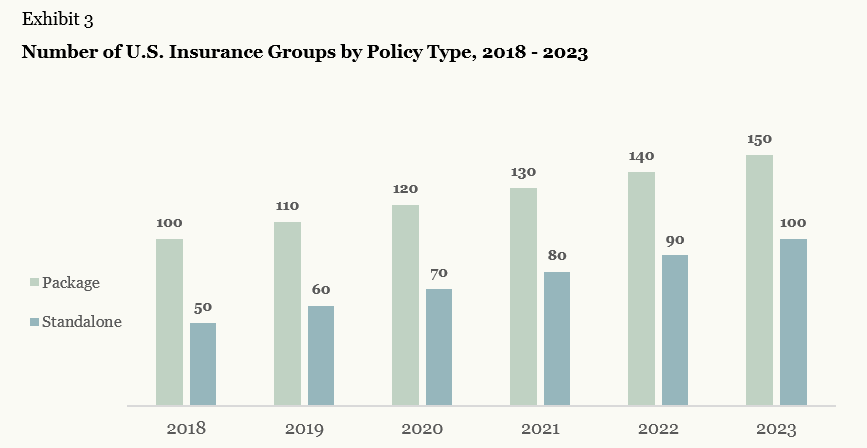

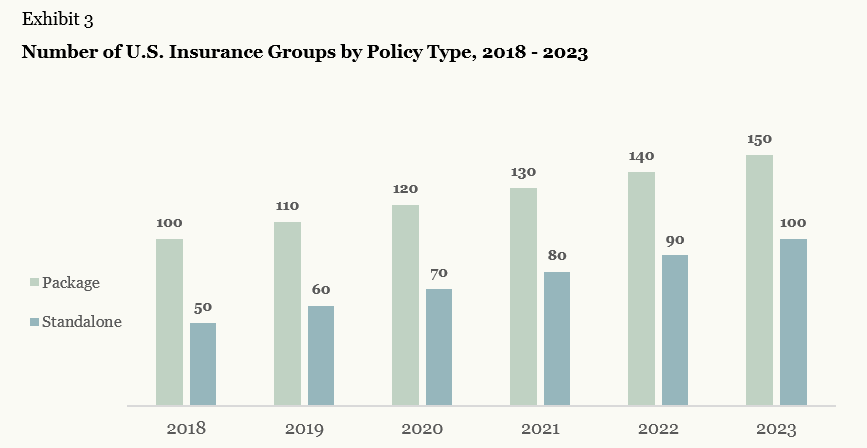

Carrier Participation: shows which insurers are active and to what extent.

Coverage Layers: highlights how carriers engage across primary, excess, and endorsement.

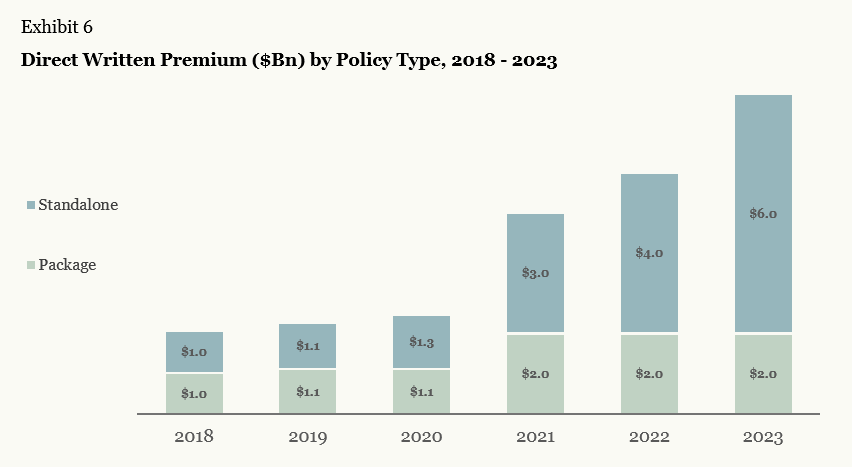

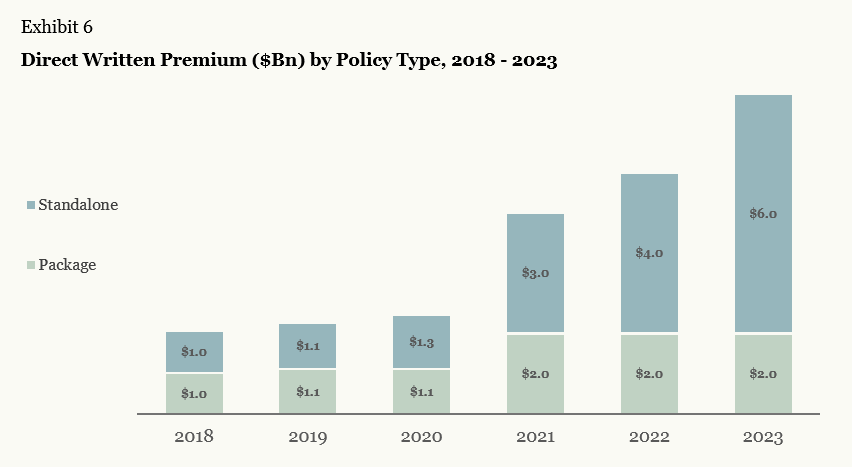

Cyber Premium by Policy Type: Breaks down premium volumes across different policy structures.

Policy Growth: Tracks changes in the number of written policies over time.

Premium Breakdown by Policy Type: Shows how premium is distributed across policy categories.

Profitability: Reviews underwriting outcomes and overall market results.

Claims Volume: Measures the total number of claims reported in the market.

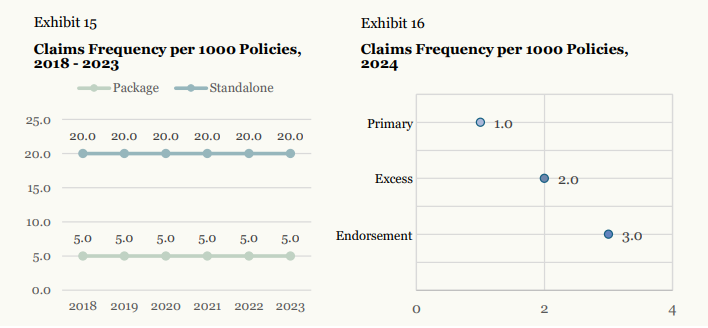

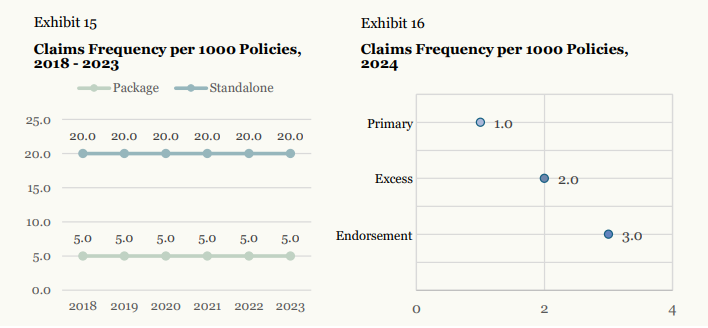

Claims Frequency: Analyzes how often claims occur relative to exposures.

Primary Insurance Market: Examines competition among carriers writing primary coverage.

Excess Insurance Market: Analyzes insurer participation in excess layers.

Endorsement Insurance Market: Analyzes the endorsement market.

Group 1: Primary and Excess Writers: Insurers active in both primary and excess layers.

Group 2: Primary, Excess and Endorsement Writers: Carriers engaged across all layers.

Group 3: Primary Only Writers: Insurers focused solely on primary coverage.

Group 4: Primary and Endorsement Writers: Carriers writing primary policies and endorsements.

QualRisk Cyber Insurance Center is the only provider of data analytics and insights from the global cyber MGA market.

Copyright @ 2025 QualRisk CYBER INSURANCE CENTER